Professional Manufacturer of Biomagnetic Beads

2025 Chinese and Import Digital PCR Instrument Market Analysis Report

1. Market Overview

The digital PCR (dPCR) instrument market in China is experiencing rapid growth, driven by advancements in precision medicine, genetic research, and COVID19 prevention and control demands. By 2025, the total market size is projected to reach CNY 40 billion (approximately $5.8 billion USD), with a CAGR exceeding 20% from 2020 to 2025.

Key Applications: Clinical Diagnostics (60% share): Cancer companion diagnostics, infectious disease detection, and genetic disorders;Research & Education (20%): University and institute labs;Agriculture & Environmental Testing (15%): Pathogen detection in crops and water quality analysis.

2. Made in China vs. Import Market Shares

1.Market Share:

Unit Sales:Dominant in midtolowend segments, accounting for 55%60% of total units sold.

Revenue Share: Lagging at 40%45%, due to lower pricing.

2.Leading Companies:

BGI Genomics: Pioneers in chipbased dPCR, offering devices priced 30%50% lower than imports.

Agilent: Focuses on agricultural testing and food safety.

LeadGene: Develops automated dPCR systems for clinical labs.

3.Advantages:

Cost-effective: Local supply chains reduce production costs.

Policy Support: Chinese government incentives (e.g., tax breaks, R&D grants) boost adoption.

4.Import Instruments

Market Share:

Revenue Share: Dominant in highend segments (60%-70%), with devices priced at $50,000–$200,000.

Technical Leadership: Global brands like BioRad, Thermo Fisher Scientific, and QIAGEN lead in precision (singlemolecule sensitivity) and automation.

5.Key Strengths:

Global Service Networks: Rapid technical support and validated protocols.

Innovation: Advanced microfluidic chip technology and AIdriven data analysis.

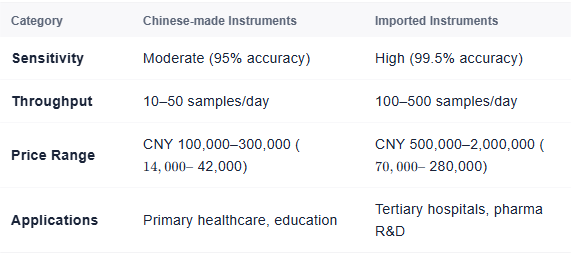

3. Technical Comparisons

4. Policy & Market Drivers

1. Chinese Government Initiatives:

14th FiveYear Plan: Mandates ≥30% domestic procurement for public hospitals.

Subsidies: Special funds support R&D for dPCR chip manufacturing.

2. Global Trends:

Precision Medicine Push: Rising demand for cancer early detection drives highend dPCR sales.

COVID19 Legacy: PandemicIncreased investment in molecular testing infrastructure, expected to continue through 2025.

5. Challenges & Future Prospects

Weaknesses of Chinese Instruments:

Technical Gaps: Droplet consistency and longsequence stability remain issues.

Market promotion: Low trust in domestic brands compared to imports.

Import Competitors’ Strategies:

Localization: BioRad establishes joint ventures in Suzhou to cut costs.

Partnerships: Thermo Fisher collaborates with BGI for cancer detection solutions.

2025–2030 Forecasts:

Chinese Market: CAGR of 25%-30%, reaching CNY 10 billion by 2030.

Global Market: China’s share of global dPCR trade to increase to 25% by 2030.

6. Investment Opportunities

HighGrowth Segments:

Cancer Companion Diagnostics: Driven by aging populations and government funding.

Environmental Testing: Postpandemic focus on water/air quality monitoring.

R&D Focus:

AI Integration: Smart dPCR platforms with automated data analysis.

Miniaturization: Portable devices for onsite testing.

Data Sources: Synthesized from industry reports including 20252030 China Digital PCR Market Forecast and Global dPCR Technology Analysis.

Supplier

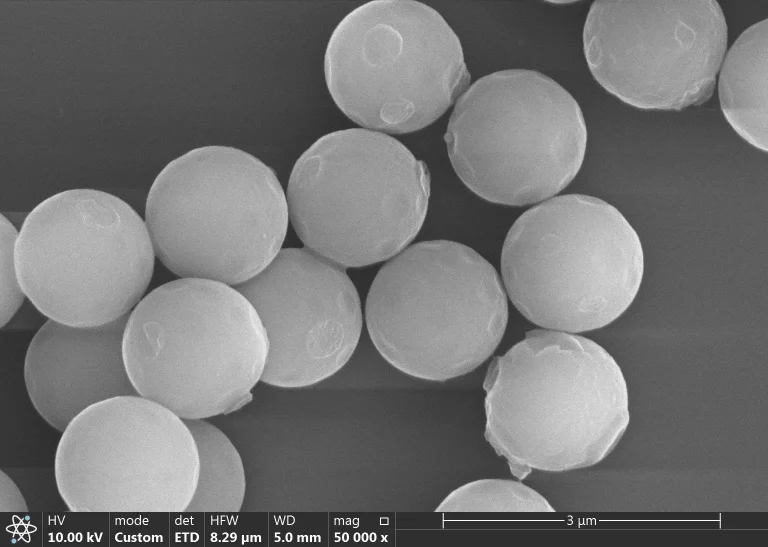

Shanghai Lingjun Biotechnology Co., Ltd. was established in 2016 which is a professional manufacturer of biomagnetic materials and nucleic acid extraction reagents.

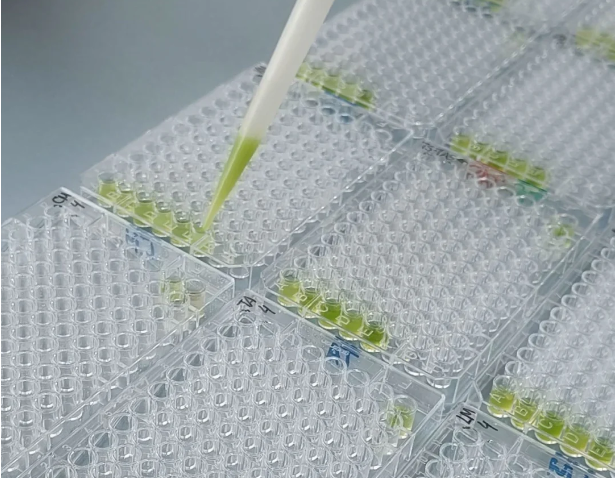

We have rich experience in nucleic acid extraction and purification, protein purification, cell separation, chemiluminescence, and other technical fields.

Our products are widely used in many fields, such as medical testing, genetic testing, university research, genetic breeding, and so on. We not only provide products but also can undertake OEM, ODM, and other needs. If you have a related need, please feel free to contact us .